Of course, there will be continued volatility, but we think that both counterparty risk and asset prices could well be quite solid going forward. Before we begin our presentation, I would like to note that this conference call will contain forward-looking statements within the meaning of the U.S. Words such as expects, anticipates, intends, estimates or similar expressions are intended to identify these forward-looking statements. Forward-looking statements are not guarantees of future performance. Welcome to the Q SFL Corporation’s earnings conference call. [Operator instructions] And please be advised that today’s conference is being recorded.

We do not have a set mix in the portfolio, focus is on evaluating deal opportunities across the segments, try to do the right transactions from a risk-reward perspective. But we try to be careful and conservative with our investments with a focus on technology and transition over time to more fuel-efficient vessels. The two drilling rigs are not included in our reported charter backlog figures. Ltd. engages in the ownership and operation of vessels and offshore related assets. It is also involved in the charter, purchase, and sale of assets.

Over the last 12 months, the EBITDA equivalent has been approximately $419 million. The net income came in at around $33 million in the quarter or $0.26 per share. The announced dividend of $0.18 per share is an increase of 20% over last quarter’s dividend and represents a dividend yield of around 9% based on closing price yesterday.

J.P. Morgan reshuffles ratings on tanker companies

Yeah, I think, I mean, we reduced the dividend from time back. But if you see over the year, I think we have committed more than $850 million in new capex. We have seen, call it, the majority of the new acquisitions coming on the balance sheet, producing cash flow.

To provide forecasts, analysts and brokers use companies’ public financial reports and speak with their employees and clients. The end result is a solution that’s marked on the chart, which shows analysts’ opinions at different periods of time. Move your cursor to track on what the dates the recommendations changed. Purchasers of the Notes may separately sell up to 8 million of the Company’s common shares that they may borrow through the Share Borrower. The Company expects that the selling shareholders will use the short position created by such sale to hedge their respective investments in the Notes. Neither the Company, nor its subsidiaries, nor its shareholders will receive any proceeds from the sale of the borrowed shares.

Tuesday’s biggest gaining and declining stocks

But right now, we feel there is so good dividend or revenue contribution that is in line with the new dividend policy of $0.18 per quarter, yeah. And we see a lot of phaseout of older vessels because there was a huge wave of vessels that came in the early 2000s, and they are now getting to 20 years of age, and therefore, very difficult to trade and very expensive to take through special surveys. So that in itself could lead to a tightness of the market.

I would now like to hand the conference over to your speaker today, Ole Hjertaker. Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. SFL earnings call difference between spot market and forward market for the period ending September 30, 2021. SFL earnings call for the period ending December 31, 2021. SFL earnings call for the period ending March 31, 2022. SFL earnings call for the period ending June 30, 2022.

Ship Finance International Ltd

With these vessels, we have 15 vessels on charter to Maersk and six vessels on charter to Evergreen. And all these vessels are on time charter terms where we are responsible for technical management and vessel operations. The Company intends to use the net proceeds received from the offering of the Notes for general corporate purposes, including working capital. The Company continuously evaluates potential transactions that it believes will be accretive to earnings, enhance shareholder value or are in the best interests of the Company. And since inception of the company in 2004, approximately $28 per share or approximately $2.4 billion in aggregate has been returned to shareholders to dividend. SFL has successfully committed close to $850 million toward accretive investments so far this year.

- The Company has a diversified fleet that operates all over the world.

- DNB Markets, Inc., Seaport Global Securities LLC, BTIG, LLC, ABN AMRO Securities (USA) LLC and ING Financial Markets LLC are acting as co-managers.

- And now, when the values have nearly doubled over the last year, we sell the vessels with a significant profit, plus additional net cash flow from trading the vessels until delivery.

- We have one more vessel in the portfolio of the same type, coming open sort of second half next year.

Recently, we have also agreed to charter out two Supramax bulkers for periods of approximately 12 months at around $24,000 per day. And we have also agreed to charter out that 2005 built 1,700 TEU feeder containership for a period of approximately three and a half years at a rate of approximately $27,000 per day. These charters alone add around $48 million to the backlog. And during the third quarter, we took delivery of five container vessels with long-term charters to Maersk and Evergreen. These vessels represent approximately $300 million charter backlog, and we will have a full cash flow effect in the fourth quarter.

Get a Better Picture of a Company’s Performance

Generate fixed income from corporates that prioritize environmental, social and governance responsibility. Discounted offers are only available to new members. The Motley Fool has no position in any of the stocks mentioned. We’ll see what — which projects actually comes together and materialize this. But what we do see here is that have the lowest order book on a relative scale since the mid-1990s, which was a record low order book level. But on — in the whole, we are — we think this market is gonna be quite robust.

And with that, I will give the word over to our CFO, Aksel Olesen, who will take us through the financial highlights for the quarter. And with respect to Seadrill and the ongoing financial restructuring, we cannot give more details than we have had disclosed in our press releases or is otherwise publicly available. After Seadrill’s plan of reorganization was approved by the court two weeks ago, they estimate emergence from Chapter 11 around year-end. We received approximately 75% of the lease hire under the existing charter agreements for West Linus and West Hercules during Seadrill’s Chapter 11 proceedings. Both rigs are active in working for all companies and the charter rate is sufficient to cover our debt service relating to these rigs.

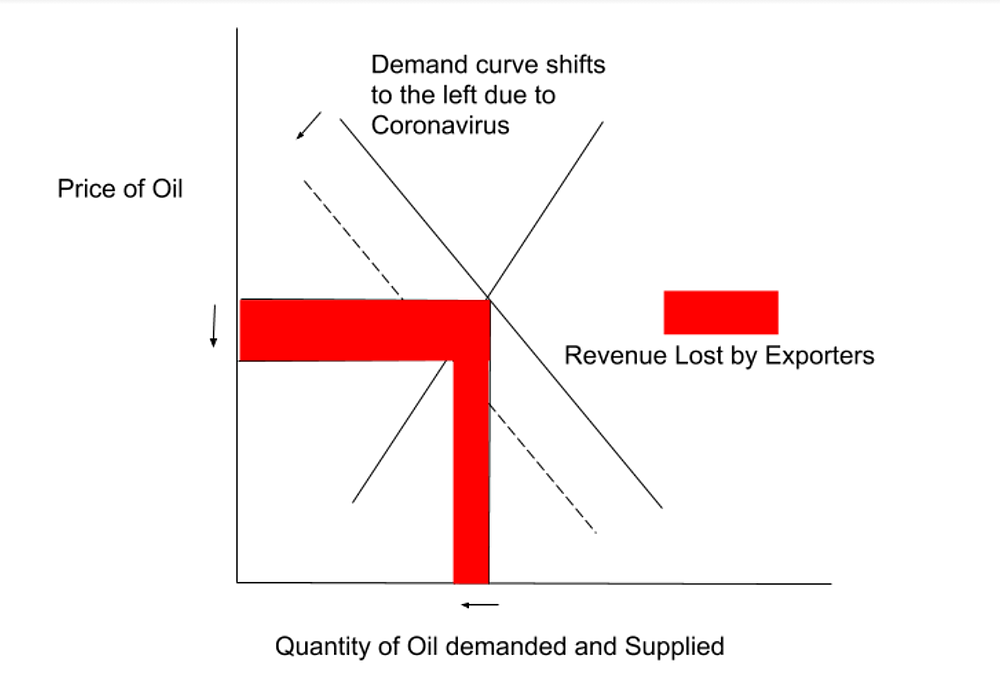

But we’ve seen now with production cuts and floating storage on winding, we’ve seen that the near term, call it, the market has been quite soft. But this is a market, as we have seen in the past, it can turn very quickly, and the price elasticity here is quite interesting. On this slide, we have shown a pro forma illustration of cash flows for the third quarter. Please note that this is only a guideline to assess the company’s performance and is not in accordance with U.S. Ardmore Shipping (ASC) witnessed a jump in share price last session on above-average trading volume.

Ship Finance International Ltd.’s (SFL) second-quarter earnings rose 48% amid a gain related to the termination of Horizon Lines Inc. (HRZL) charters and contributions under its amended agreement with Frontline Ltd. (FRO, … Dividend capture strategy is based on SFL’s historical data. Build conviction from in-depth coverage of the best dividend stocks. And then, just realizing you were able to execute on that that Suezmax transaction which was — I mean, you — people would argue, hey, that’s a good move, that’s sort of countercyclical investing. Are you — as we think about the challenges facing the tanker market over the last year, and we’ll see how this winter play — this winter market develops and into next year.

Bangladesh to import more LNG from international spot market – Hellenic Shipping News Worldwide

Bangladesh to import more LNG from international spot market.

Posted: Mon, 11 Sep 2023 13:59:46 GMT [source]

We — so we are not necessarily looking to sell more ships right now. The same sort of evaluation also goes for our sort of older, smaller bulker vessels at the moment. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Also known as “moderate buy”, “accumulate”, and “overweight.” Outperform is an analyst recommendation meaning a stock is expected to do slightly better than the market return. A recommendation that means a stock is expected to do slightly worse than the overall stock market return. Underperform can also be expressed as “moderate sell”, “weak hold” and “underweight.”

During the quarter, the company secured attractive financing for four large container vessels in the form of senior secured bank financing and Japanese operating leases with total proceeds of approximately $260 million. Approximately $420 million of remaining capex for recently accounted acquisitions is expected to be financed by debt facilities, similar to SFL’s other assets with long-term charters. Subsequent to quarter end, approximately $148 million was used to repay the balance of the convertible bond due in mid-October. Furthermore, the company expects to receive approximately $98 million in cash proceeds from the sale of seven Handysize bulk vessels during the fourth quarter as they are currently debt-free.

The Company intends to use the net proceeds received from the offering of the Notes for general corporate purposes, including working capital and the repurchase of all or a portion of its existing 3.25% convertible notes. Frontline Ltd.’s FRO fourth-quarter loss narrowed as revenue improved, but the company warned that overcapacity in the tanker market could lead to significant financial problems. The vessels will enter into a long term bareboat charter with Horizon Lines and will operate in their expanded TP1service from the U.S.

This trading strategy invovles purchasing a stock just before the ex-dividend date in order to collect the dividend and then selling after the stock price has recovered. By 2022, SFL’s earnings should reach US$162m, from current levels of US$74m, resulting in an annual growth rate of 26%. This leads to an EPS of $0.96 in the final year of projections relative to the current EPS of $0.70.

Over 200 Securities Yielding 5% or More

And over the years, we have paid nearly $28 per share in dividends or around $2.4 billion in total. And we have an increased fixed rate charter backlog supporting continued dividend capacity going forward. And we are, of course, pleased to see strengthening drilling markets on the back of the firm oil price. During the third quarter, we entered into amendments to the charter agreements relating to the semisubmersible drilling rig, West Hercules. Under the amendment agreement with Seadrill, the West Hercules is contracted to be employed with oil major Equinor in Norway and Canada until the second half of 2022 and thereafter, redelivered to SFL in Norway.

In addition, we have excluded charter hire relating to the drilling rigs to be conservative in light of the ongoing financial restructuring in Seadrill. We continue building the portfolio with modern assets on long-term charters and have recently agreed to acquire three modern 2019 built Suezmax tankers in combination with time charters to one of the leading commodity training companies. This deal includes some interesting optionality features if the market should strengthen during the charter period where sales can be triggered with a profit split.

The latest trend in earnings estimate revisions for the stock doesn’t suggest further strength down… Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. NEW YORK (MarketWatch) — Ship Finance International Ltd.’s board approved a share buyback program of up to 7 million shares. The Hamilton, Bermuda, crude-oil shipping company plans to finance all or part

of the buyback b… This is the week for market prognosticators’ midyear updates — and the time to assess tactical moves you should make to your portfolio, right now. And we do mean right now, since Tuesday’s steep decline shows that reality…

These statements are based on our current plans and projections and are inherently subject to risks and uncertainties that could cause future activities and results of operations to be materially different from those set forth in the forward-looking statements. Important factors that could cause actual results to differ include, but are not limited to, conditions in the shipping, offshore and credit markets. You should, https://1investing.in/ therefore, not place undue reliance on these forward-looking statements. Please refer to our filings with the Securities and Exchange Commission more detailed discussion of our risks and uncertainties, which may have a direct bearing on our operating results and our financial condition. The oil tanker market has been through a disastrous long-term decline but all indications are that the market has bottomed.

We analyze two very cheap stocks, in two very different industries. Also known as strong sell, it’s a recommendation to sell a security or to liquidate an asset. Jefferies LLC, ABG Sundal Collier, Inc. and Morgan Stanley & Co. LLC will act as underwriters, Seaport Global Securities LLC and Clarksons Platou Securities, Inc. will act as co-managers, for the offering of the Notes. LLC, Jefferies LLC and Citigroup Global Markets Inc. are acting as joint book-running managers for the offering of the Notes.

- In addition, we also saw an increase in depreciation due to the new additions to the fleet during the quarter.

- Over the last 12 months, the EBITDA equivalent has been approximately $419 million.

- To provide forecasts, analysts and brokers use companies’ public financial reports and speak with their employees and clients.

- Helpful articles on different dividend investing options and how to best save, invest, and spend your hard-earned money.

- Oil tanker stocks are some of the highest yielding investments around, but the sector is fraught with danger.

We expect the vessels to be delivered later this year and early in the first quarter. For bareboat deals, this value is usually retained by the charter through fixed price purchase options. And this is illustrated by the recent sale of the seven Handysize bulkers where our operating platform has enabled us to trade the vessels in the spot market during the soft market for a period. If you look at the counterparties, it is now mainly to end users and market leaders in the respective segments and relative few are to intermediaries where we have less visibility on the use of the assets and quality of operations. Strategically, this also gives us access to more deal flow opportunities such as to repeat business with Maersk, MSC and Evergreen, for example. Our strategy has therefore been to maintain a strong technical and commercial operating platform in cooperation with our sister companies in the Seatankers Group.

Our Chief Operating Officer Trym Sjolie will also be present for the Q&A session. Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest… The shipping conglomerate’s dividend payout ratio has spiked in recent months.

Leave A Comment